7 Types of Public Trading Strategies That Actually Work

- Day Trading: Quick profits from intraday price movements

- Swing Trading: Capturing medium-term market swings over days or weeks

- Value Investing: Finding undervalued stocks with strong fundamentals

- Growth Investing: Targeting companies with high growth potential

- Dividend Investing: Building income through dividend-paying stocks

- Index Fund Investing: Diversified exposure to entire market segments

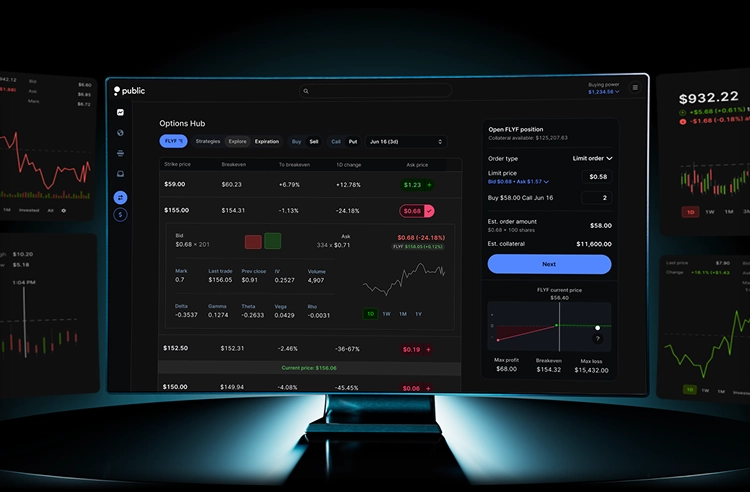

- Options Trading: Advanced strategies using derivatives for hedging and income